A parent dropped off her kindergarten child at our centre and mentioned, “My daughter has $4 but wants a $10 stationary item. Can you help her figure out how much more money she needs, so she can do some extra chores at home?” This little moment highlights how early lessons in money can shape a lifetime of financial responsibility.

Following other provinces, Alberta has recently implemented a financial literacy program within its curriculum. From grades K-6, students are expected to engage with money concepts in math to support the financial literacy skills learned in physical education and wellness. Moreover, the government is making a substantial investment in financial literacy programming, As Adriana LaGrange, the minister of education stated in May 2022, “This will give Alberta’s next generation the much needed financial knowledge and skills for personal and professional success.”

How early should the concept of money introduced?

It’s earlier than you may think. According to a study by the University of Cambridge, children may start to understand counting as early as 2 to 3 years old, and by the age of 7 they have developed many of the basic concepts related to financial behaviours.

Guidance on the age-appropriateness teaching the concept of money

Kindergarten:

We recognize that the use of cash is becoming less common in today’s digital world, much like the shift from analog to digital clocks, and that’s why many kids – even middle-schoolers – do not know what a dime is worth, or a nickel.

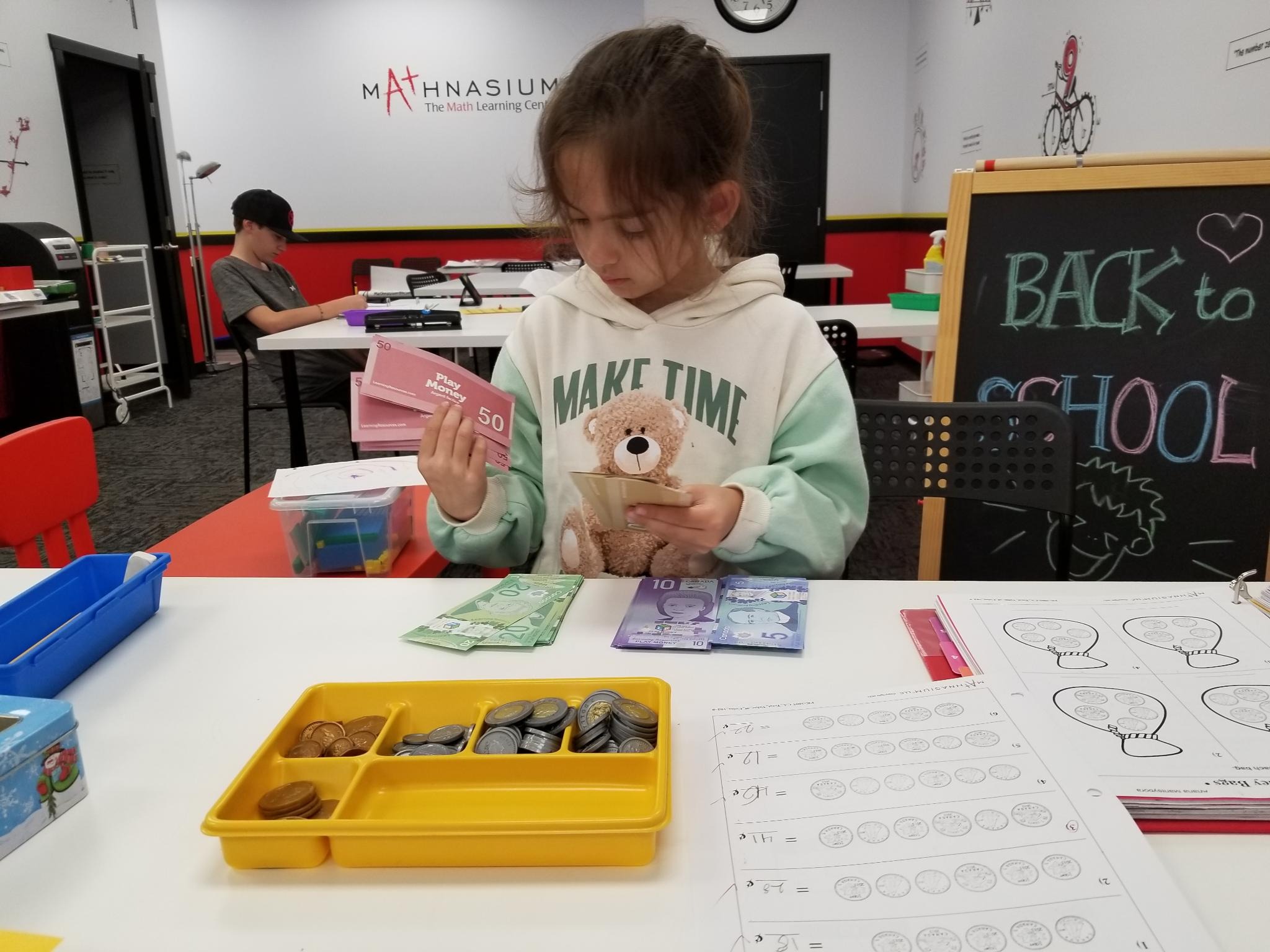

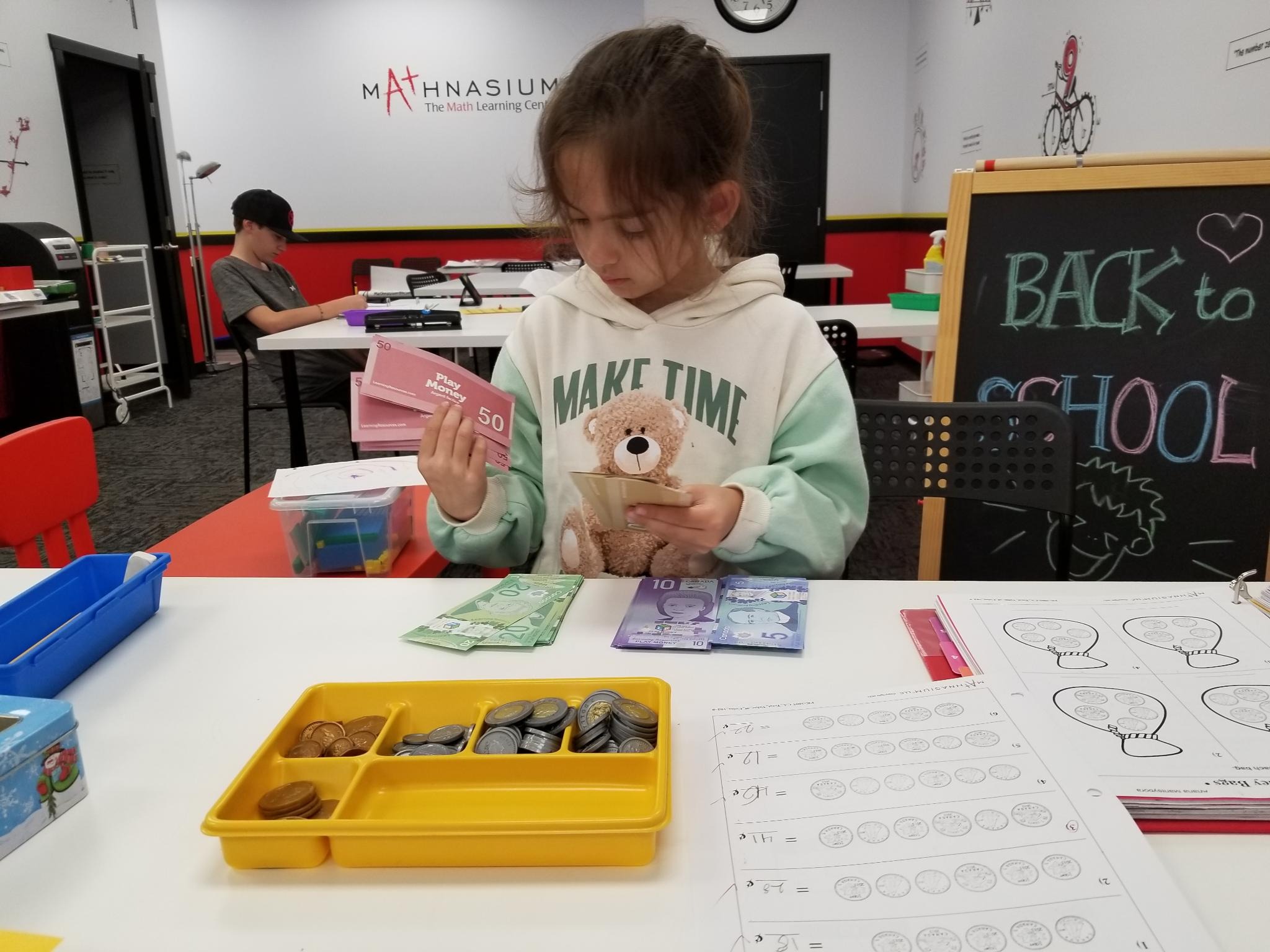

At Mathnasium we start introducing the concept of money by having them learn about the worth of coins at the kindergarten level, from a penny to a toonie. But .. we don’t use pennies anymore, you may think. Yes and no 😊 While pennies are not used physically, they still play a role in how we price items, such as $6.99 or $6.97.

Recognizing the value of coins, they understand that “bigger size doesn’t always better” because a dime is actually smaller than a nickel, but the value is bigger.

Grade-1

As students progress to Grade-1, they learn not only to recognize different coins but also to calculate the total value of a combination of coins. For instance, “what is the total worth of 4 dimes, 5 nickels, and 3 pennies?

Moreover, they begin to understand that different combination of coins can represent the same value, a fundamental skill in handling money.

Grade-2

-

Coin Equivalency: students begin to explore the concept of coin equivalency, which ties to another essential math concept, proportional thinking or thinking in groups – such as how many nickels are in 3 quarter, or how many toonies make up 14 loonies.

-

Money Change: Another crucial concept at this level is understanding money change, typically limited to transactions under $1.00. For example, students may be asked how much change they'll receive when paying with a Loonie for a 74 cents lollipop. It's important to note that students might commonly respond with 36 cents instead of 26, often subtracting 70 from 100 instead of 80.

-

Total Value of Coins: they learn to determine more advanced calculations of finding the total value of various coin combinations, like 2 quarters, 3 dimes, 1 nickel and 3 pennies.

Grade-3

- Coin Equivalency: students continue to build their understanding on coin equivalence, probing into more complex scenarios. They handle questions like, “How many dimes are equivalent to 18 quarters? Or “How many loonies can you make from 60 nickels?”

- Making Change: students advance their skills in dealing with making changes from multiples of one dollar. For instance, if a purchase costs $1.67, and you pay with a $5.00 bill, calculating the change can be challenging. Many students, especially those who have learned decimal subtraction, might rely on the algorithm method of stacking numbers. However, we emphasize a more efficient approach: starting with the next dollar (in this case, $2.00) and then moving to $5.00. This method results in an answer of 33 cents plus $3.00. At Mathnasium, we've heard young learners surprise their parents by confidently calculating change during real-life shopping trips.

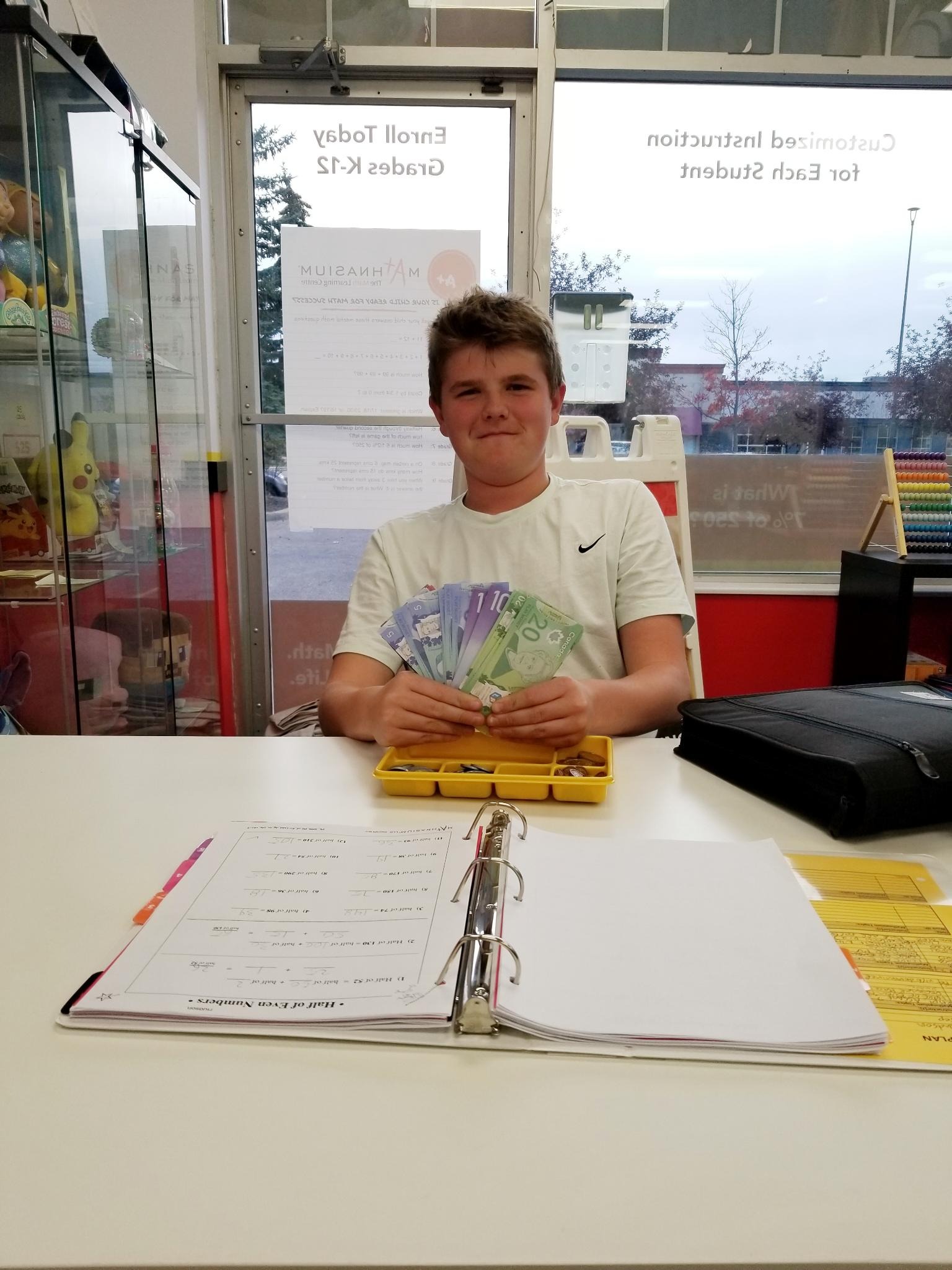

Higher Levels

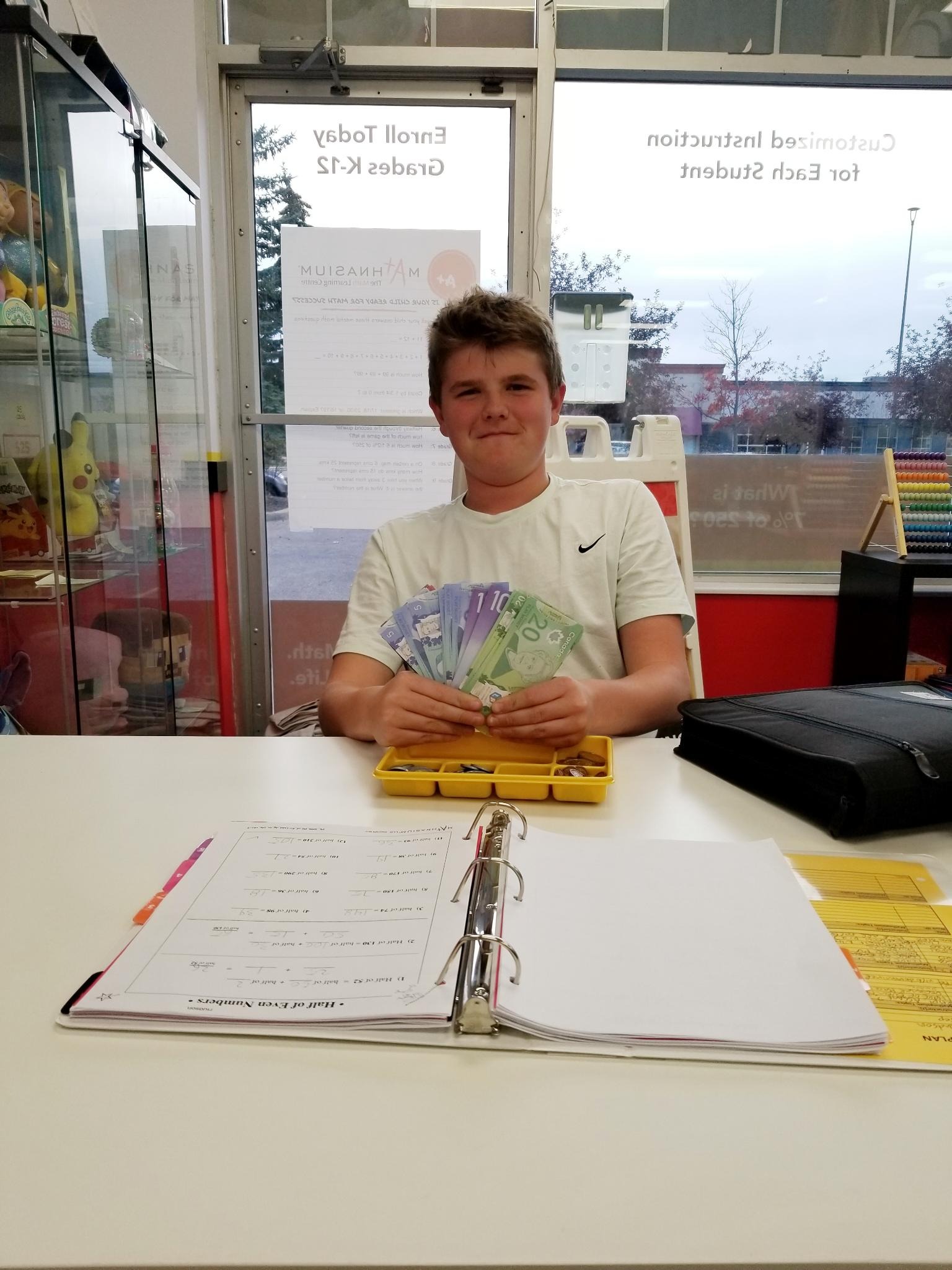

As students progress to higher levels, money concepts become more intertwined with advanced math concepts like percentages, estimation, portioning, and ratios.

Take, for example, a Grade 5 scenario where Steve, Randy, and John purchase a package containing 48 tissue boxes. Steve paid $5, Randy paid $3, and John paid $8. The question arises: How should they divide the tissue boxes to ensure each person gets a fair share? Here, students not only apply their understanding of division but also begin to explore the principles of fairness and equitable distribution.

In Grade 6 or 7, as students delve into decimal long division, they encounter more complex money-related problems. One such problem involves calculating unit prices to determine the better buy. For instance, they might be asked to compare the cost of 6 bagels for $5.50 with 13 bagels for $11.05.

While calculators are readily available in real life, the beauty of learning math extends beyond obtaining the correct answer. It's about building students' conceptual understanding, problem-solving abilities, and critical thinking skills.

In a trip to a grocery store with my son, I made him realize that in addition to comparing absolute prices, he needed to consider factors like item weight or size to make informed purchasing decisions. This is particularly important in today’s economic situation, marked by soaring inflation rates.

More advanced grades can learn about budgeting and expenses, savings & investing, and furthermore about credit and the consequence of debt.

Empowering the next generation for financial success

Incorporating financial literacy in the curriculum, from the earliest years to high school not only provides students with practical money management skills, but also nurtures a mindset of financial responsibility and savvy decision making. The next generation will be better prepared to navigate the complex financial landscape they will encounter in adulthood.